JOHANNESBURG/NEW YORK — Cyril Ramaphosa smiled broadly while telling business leaders about his plans to transform South Africa into an investment hub.

The country’s president, speaking at a meeting on the sidelines of the United Nations General Assembly in New York last week, had every reason to be happy. South African stocks are on a tear, while the coalition government has buoyed hopes that the country’s debilitating power and transport problems can be fixed.

“The business community is responding very positively to our reforms,” he said at the meeting, a roundtable event bringing together executives, bankers, and officials from a variety of governments and finance institutions.

“We are pointing in the right direction and our reforms are starting to gain traction,” said Ramaphosa, adding that his government’s policies “will improve the business operating environment and attract investment.”

Ramaphosa’s positive message has been matched by investor sentiment around South Africa. The country’s stocks have had their strongest third quarter for 11 years, and quarterly index measuring consumer sentiment compiled by the Bureau for Economic Research has also ticked up to pre-covid levels.

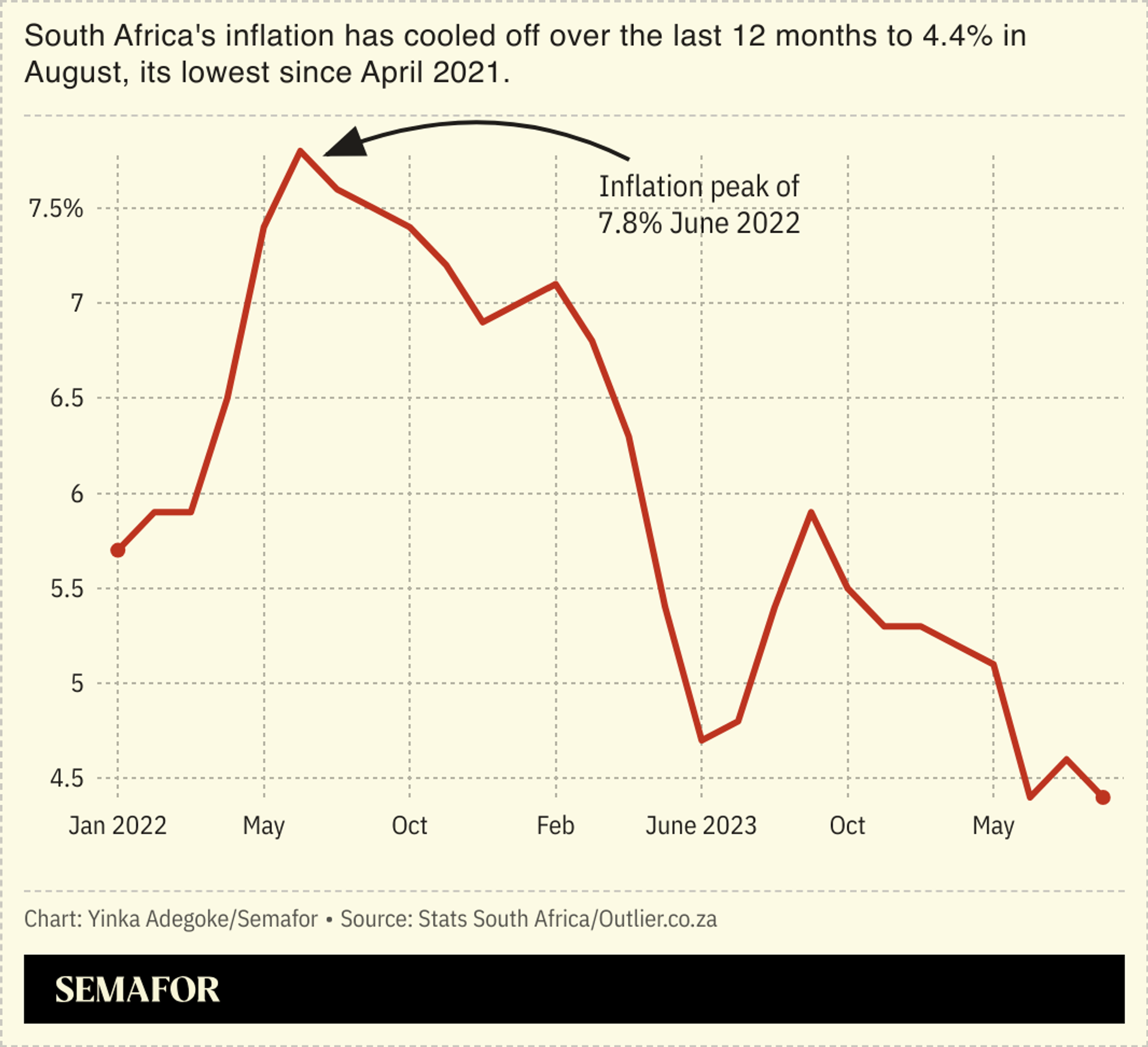

South Africa has not endured the rolling nationwide power cuts that throttled the economy — known as “loadshedding” — for around six months, which analysts cite as a key factor in the country’s resurgence. That has been helped by the central bank cutting its main interest rate last month for the first time since 2020 amid slowing inflation, days after the U.S. Federal Reserve’s rate cut signaled a shift in global monetary policy.

This article was originally published by a www.semafor.com . Read the Original article here. .